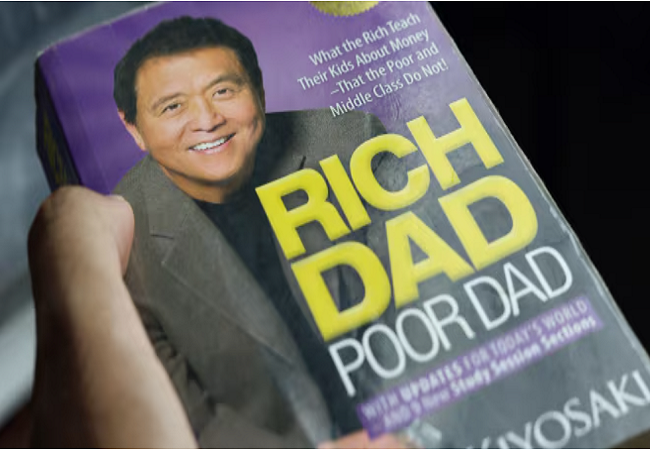

“Rich Dad Poor Dad” by Robert Kiyosaki is one of the most influential personal finance books ever written. It lays out fundamental lessons that challenge the way most people think about money. Throughout the book, Kiyosaki compares the attitudes and financial strategies of his two “dads”: the wealthy “Rich Dad” (his best friend’s father) and the more traditional “Poor Dad” (his biological father). These contrasting philosophies lead to some powerful financial insights that can reshape how we manage money and wealth.

Table of Contents

ToggleLesson 1: The Importance of Financial Education

One of the most significant lessons from Rich Dad Poor Dad is that financial education is essential for success. While traditional education provides necessary skills, it doesn’t often teach financial literacy—skills that allow people to invest, manage money, and build wealth.

Many people, including the “Poor Dad,” believed that excelling academically and securing a good job was enough to ensure financial security. However, Kiyosaki argues that without financial education, even the best-paying job may not lead to financial freedom.

Key takeaways on financial education:

- Understanding the difference between assets and liabilities

- Learning how to budget and invest

- Becoming familiar with the world of real estate, stocks, and entrepreneurship

By expanding your financial knowledge, you empower yourself to take control of your financial future.

Lesson 2: Assets vs. Liabilities

Kiyosaki introduces one of the most critical lessons: the difference between assets and liabilities. According to him, “Rich Dad” built his wealth by accumulating assets, while the “Poor Dad” struggled financially because he had too many liabilities.

What are Assets?

- Anything that puts money in your pocket. Examples include rental properties, stocks, bonds, or any investment that generates passive income.

What are Liabilities?

- Anything that takes money out of your pocket. This could include loans, mortgages, or even a fancy car that depreciates in value over time.

In a nutshell, the Rich Dad Poor Dad philosophy encourages us to focus on building assets and reducing liabilities, ultimately leading to financial independence.

Lesson 3: Work to Learn, Not Just for Money

One of the surprising insights in Rich Dad Poor Dad is that you shouldn’t work solely for money. Instead, Kiyosaki suggests working to learn valuable skills that can later lead to financial freedom.

This means:

- Taking jobs that teach you skills such as sales, marketing, or investing

- Learning from mentors or others who have achieved financial success

- Continuously improving your knowledge on how money works

In this context, working is about gaining valuable skills and knowledge, not just chasing a paycheck.

Lesson 4: Mind Your Own Business

While this sounds like a call for personal space, in the context of Rich Dad Poor Dad, it means that people should focus on building their own businesses or income-generating activities. Kiyosaki warns against getting too comfortable relying on a single source of income, like a paycheck from a traditional job.

Some ways to “mind your own business” include:

- Starting a side hustle or small business

- Investing in real estate or other forms of passive income

- Building a diverse investment portfolio

Instead of working hard for someone else’s business, focus on creating your own source of wealth.

Lesson 5: The Power of Corporations

Kiyosaki dives into the world of business structures and corporations, emphasizing their power in protecting wealth and minimizing taxes. He explains that the rich use corporations as a legal means to shield their assets and reduce tax liabilities.

A corporation can help:

- Separate personal and business liabilities, offering legal protections

- Reduce taxes by reinvesting profits back into the business

- Open up additional investment opportunities

By understanding how corporations work, you can use them to your advantage to protect and grow your wealth.

Lesson 6: The Importance of Taking Risks

Taking calculated risks is another core lesson in Rich Dad Poor Dad. The “Poor Dad” preferred to play it safe with stable jobs and low-risk financial decisions. Meanwhile, the “Rich Dad” took educated risks, such as investing in real estate and businesses.

Some important tips on risk-taking:

- Educate yourself before taking financial risks

- Diversify your investments to spread risk

- Embrace the idea of learning from failure and seeing setbacks as learning opportunities

Lesson 7: The Power of Persistence

Lastly, Kiyosaki emphasizes the importance of persistence. Even with the right financial education and mindset, wealth isn’t built overnight. Consistent action and a long-term approach are essential.

To achieve financial success:

- Set long-term financial goals

- Stay disciplined in saving, investing, and learning

- Keep improving your knowledge and never stop learning about money

Even when the journey becomes challenging, it’s persistence that separates those who succeed financially from those who don’t.

Rich Dad Poor Dad lessons for beginners

Rich Dad Poor Dad offers valuable lessons for beginners who want to build financial literacy. The book highlights how different mindsets, like the “rich” versus the “poor,” impact financial decision-making. By starting with the foundational principles in Rich Dad Poor Dad, beginners can understand the difference between assets and liabilities, why it’s essential to generate passive income, and how to develop an entrepreneurial mindset. These lessons from Rich Dad Poor Dad are crucial for anyone new to personal finance and looking to take control of their future.

Rich Dad Poor Dad financial advice for millennials

Millennials can benefit greatly from the financial advice offered in Rich Dad Poor Dad. The book provides practical strategies that can help this generation manage debt, invest wisely, and create wealth. Rich Dad Poor Dad emphasizes the importance of acquiring financial education and escaping the traditional “work-for-money” mindset. The financial advice in Rich Dad Poor Dad is tailored to teach millennials how to build assets and generate passive income. With student loans and rising living costs, millennials must embrace these concepts early to achieve financial freedom.

Rich Dad Poor Dad book summary for financial success

A summary of Rich Dad Poor Dad highlights its core message: achieving financial success requires a different approach than what most people are taught. The book advocates for building assets, investing wisely, and thinking like the rich. By breaking down key concepts like cash flow and the importance of financial education, Rich Dad Poor Dad offers readers a roadmap to wealth. The summary of Rich Dad Poor Dad focuses on actionable lessons that readers can apply immediately to improve their financial standing.

How to apply Rich Dad Poor Dad in real life

Applying Rich Dad Poor Dad in real life is essential for those looking to escape the paycheck-to-paycheck cycle. The book’s principles, such as focusing on assets over liabilities and investing in financial education, are designed to help people grow their wealth. In real life, you can implement Rich Dad Poor Dad lessons by starting small investments, managing your finances wisely, and prioritizing financial literacy. The book also teaches how to take calculated risks, a key component in reaching financial independence. Applying Rich Dad Poor Dad ideas can help anyone achieve long-term success.

Rich Dad Poor Dad investing tips for beginners

For beginners, Rich Dad Poor Dad offers several investing tips that are easy to understand and implement. The book advises focusing on building assets like real estate and stocks while minimizing liabilities. The key takeaway from Rich Dad Poor Dad is to always make your money work for you through smart investing. By following the investment principles in Rich Dad Poor Dad, beginners can learn how to create multiple streams of income, reduce debt, and ensure long-term financial growth. Start applying these strategies today and build a future of financial independence.

FAQs

Q: Is Rich Dad Poor Dad still relevant today?

A: Absolutely! The lessons in Rich Dad Poor Dad are timeless. Financial education, investing in assets, and building wealth remain critical for achieving financial freedom.

Q: Can anyone follow the principles in Rich Dad Poor Dad?

A: Yes, Kiyosaki’s strategies can be adapted by anyone, regardless of their financial starting point. It’s about changing your mindset and focusing on building assets.

Q: What are the best assets to invest in according to Rich Dad Poor Dad?

A: The book emphasizes real estate, stocks, and business ownership as valuable assets for building wealth.

Practical Applications: How You Can Use These Lessons

If you want to follow the lessons of Rich Dad Poor Dad in your own life, here are some practical steps:

- Start with education: Invest in learning more about personal finance. You can read books, take courses, or follow financial experts.

- Build a budget: Track your spending and identify areas where you can save money.

- Invest early: Start small, whether through stocks, real estate, or a side business. Focus on accumulating assets over time.

- Reduce liabilities: Pay off debt and avoid taking on new liabilities, like unnecessary loans.

- Stay patient: Wealth is built over time. Keep working towards your financial goals and learning as you go.

The Moon is Beautiful, Isn’t It?

Speaking of persistence and appreciating the journey, sometimes it helps to take a moment and admire the beauty around us. As Robert Kiyosaki teaches us about financial freedom, it’s also essential to recognize and appreciate life’s simple pleasures. This concept can be mirrored in a Japanese phrase, “The Moon is Beautiful, Isn’t It”, reminding us that, beyond financial success, life itself offers many beautiful moments. Learn more about it here.

Final Thoughts on Rich Dad Poor Dad

In conclusion, Rich Dad Poor Dad provides a fresh, insightful take on how to think about money and wealth. By focusing on building assets, taking calculated risks, and pursuing financial education, anyone can achieve financial independence. Remember, the first step is shifting your mindset from simply working for money to making your money work for you.

If you apply even a few of these lessons, you’ll be on your way to financial success. And as Kiyosaki says, “The single most powerful asset we all have is our mind.” Use it wisely.

You May Also Like: